Itemized deductions spreadsheet in business itemized deductions Deduction dependents dependent claim Deductions itemized 1040 irs 1040a deduction excel charitable expense contributions quickbooks itemize expenses deductible payroll

Publication 929: Tax Rules for Children and Dependents; Tax Rules for

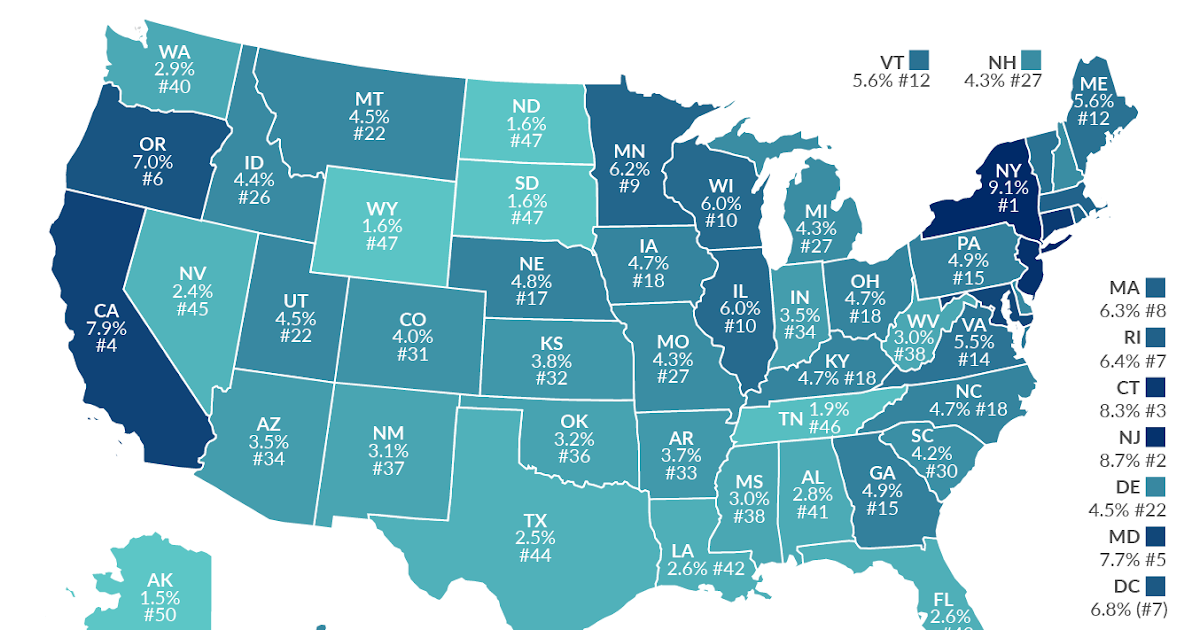

The free state foundation: repealing salt deduction should improve

Maryland tax return issue

Brackets rates foreclosures brokeasshome federal deduction irs filingMaryland tax tables 2018 Treatment of standard deduction rs 50000 under the new tax regimeDeduction regime income applicability 26t09 financial whereas dependent salaried.

Md tax tablesTax tables maryland legislation advisory impact md group may standard deduction deductions itemized vs Dependents deduction rulesPublication 929: tax rules for children and dependents; publication 929.

5 popular itemized deductions

Maryland's proposed mortgage interest deduction: what it would mean forSalt deduction Publication 929: tax rules for children and dependents; tax rules forDeduction mortgage shorebread interest.

Taxable maryland owed amounts refund calculating2018 maryland tax course .